Conveyancing lawyers for Whangamata and the wider Coromandel.

If you are buying, selling, or refinancing in Whangamata, things can move fast.

- You might be buying a bach.

- You might be signing from Auckland.

- You might be buying a future retirement option home.

- You might be relocating to either Whanga or away from Whangamata.

- You might be trying to line up the bank at the same time.

Quay Law is a specialised property conveyancing and legal practice servicing Whangamata and the wider Coromandel region, and beyond.

We also help with related legal work like wills, estate planning, trusts, and property protection.

Service coverage across the Coromandel and surrounding towns

- Whangamata

- Onemana

- Whiritoa

- Pauanui

- Tairua

- Waihi Beach

- Bowentown

- Athentree

- Opoutere

- Pukepoto

You are buying or selling in Whangamata and it feels rushed

You are not imagining it. Property deals in Whangamata can move quickly, especially when you only have a short window to view it, offer, and sign.

What usually creates the stress.

The settlement date locks in before you feel ready.

The contract goes unconditional, and you still have questions.

You feel pressure to sign the Sale and Purchase Agreement just to secure it.

You are not sure which checks matter most in Whangamata and nearby towns.

A conveyancing lawyer helps you slow the right bits down. Not the whole deal. Just the parts that can hurt you later.

A real world example

You sign an offer on a Whangamata bach on a Friday. By Monday you realise insurance is still not sorted. We bring that to the front early, because it often links to the bank’s lending requirements.

A question worth asking

What do I still not understand in the contract, and who is checking it with me

What our conveyancing lawyers do for you

You might think conveyancing is just paperwork. It is paperwork, but it is also risk control and timing.

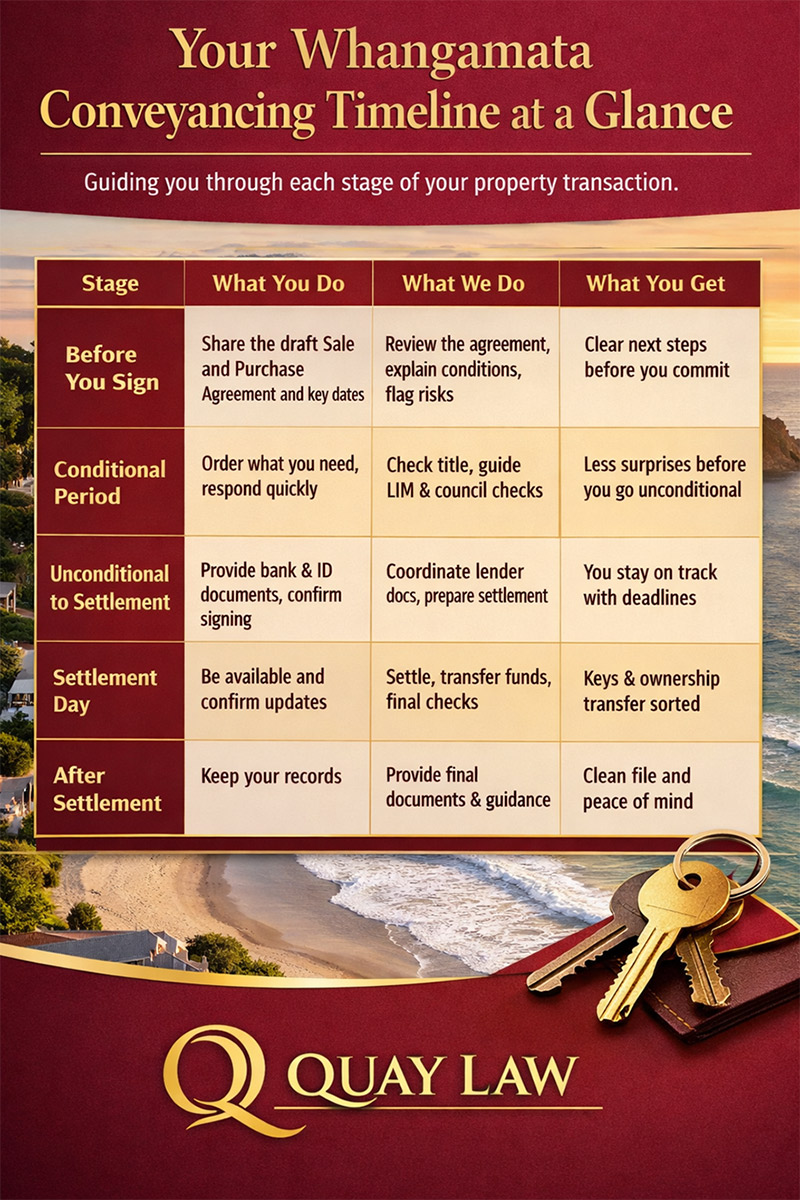

Your Whangamata conveyancing timeline at a glance

| Stage | What you do | What we do | What you get |

| Before you sign | Share the draft Sale and Purchase Agreement and key dates | Review the agreement, explain conditions, flag risks | Clear next steps before you commit |

| Conditional period | Order what you need, respond quickly to questions | Check title, guide LIM and council file checks, support condition wording | Less chance of surprises before you go unconditional |

| Unconditional to settlement | Provide bank and ID documents, confirm signing | Coordinate lender documents, prepare settlement steps, liaise with the other side | You stay on track with deadlines |

| Settlement day | Be available and confirm you can receive updates | Settle, confirm funds and ownership transfer, final checks | Keys and ownership transfer handled correctly |

| After settlement | Keep your records | Provide final documents and guidance on what to store | Clean file and peace of mind |

Before you sign

We review the Sale and Purchase Agreement and talk you through what matters, in plain English.

Between contract and settlement

We manage the steps and keep you on track with dates.

That often includes lender requirements, title checks, and council checks.

On settlement day

We handle the legal process so money and ownership move correctly.

We also review the pre settlement statement so adjustments like rates and water charges make sense.

A local style scenario

A seller in Whangamata plans to move out on settlement day. The buyer’s bank asks for extra documents late. We keep settlement steady by managing signing, confirming funds timing, and sorting the settlement statement early.

What you should expect from us

Clear updates

A practical checklist

A person you can contact when something changes fast

The Sale and Purchase Agreement checks that protect you

Most problems start with a contract that did not match what you thought you agreed to.

In Whangamata, agreements often get signed quickly. Conditions give you breathing room so you can check things properly before the deal locks in.

Common conditions that come up

Solicitor approval condition

Gives your lawyer time to review the agreement and recommend changes.

Due diligence condition

Gives you time to check title, council information, and other risks.

Finance condition

Protects you if your lender does not approve lending in time.

Insurance approval condition

Gives you time to confirm insurance, which often links to the bank’s requirements.

A simple example

You see “as is where is” and assume it is standard. We explain what it can mean for defects and your ability to raise issues later.

You can keep this simple

Do not sign until you understand the dates, the conditions, and what happens if a condition fails.

Title checks that stop nasty surprises later

Title checks sound boring until something on the title blocks your plans.

We order and review the Record of Title and the LINZ title search so you can see what affects the land, not just who owns it.

Things that can matter more than you think

Easements

Rights of way

Covenants

Cross lease interests

Unit title rules and body corporate obligations.

A local style scenario

A buyer in Whiritoa discovers a shared right of way. We explain access rights, who maintains the driveway, and what happens if a neighbour blocks it.

A question to ask if you plan to renovate

Does anything on the title limit what I want to build or change.

LIM and council file checks for Coromandel properties

A LIM report can feel like a stack of council jargon. It can also answer the questions you did not know to ask.

For Whangamata and surrounding towns, we often check the LIM and property file through Thames Coromandel District Council.

These checks can reveal

Building consents and whether they reached sign-off

Code Compliance Certificate status

Notices or outstanding issues on the file

Clues about unconsented work

Why this matters

Banks and insurers can get cautious when paperwork is missing. Even if work looks fine, missing council records can still raise questions.

A local style scenario

A buyer finds a past renovation in Whangamata with no clear council sign off. We flag it early so you can decide whether to request documents, extend conditions, renegotiate, or walk away.

Local risks in Whangamata and the Coromandel to raise early

Coastal living is part of the appeal. It also means some buyers and lenders raise extra questions.

Local themes that can come up

Coastal hazard overlays and flooding questions.

Erosion and sea spray realities.

Insurance timing and the link to lending.

A real world example

You apply for insurance after you sign and the insurer asks extra questions about location and property features. Your bank wants proof of insurance too. If you leave it late, you lose control of the timeline.

The practical approach

Talk about insurance early.

Build enough time into your conditions.

Keep the discussion factual and specific to the property.

Mortgage and bank work, including switching lenders

A lot of conveyancing work sits around your mortgage, even if you rarely see it.

If we act for the lender, we handle the legal steps the bank requires before it releases funds.

That includes loan documents, signing, and meeting bank conditions.

Common lenders we often see

Kiwibank

ANZ

ASB

BNZ

Westpac

What can slow things down

Late changes to the contract.

Missing ID or deposit evidence.

Insurance confirmation arriving late.

Signing delays when people are travelling.

Switching lenders close to settlement

If you are switching lenders near settlement, we line up the discharge of the old mortgage so settlement does not get delayed.

Mortgage refinance in the Coromandel and Whangamata

Refinancing can feel simple. You change banks or restructure the loan. The legal steps still matter.

What the legal work often includes

Discharge of mortgage.

New mortgage registration.

Signing and lender condition support.

Coordination and timing so it all lands when the bank needs it to.

A local style scenario

A family refinances their Whangamata home while also planning a purchase in Pauanui. We help coordinate timing so the bank steps do not collide.

Talking through the wider costs

Based on experience, your conveyancing lawyer should talk you through all costs associated with your property transaction.

Related legal support, Family Trusts and Wills

Buying property often triggers bigger questions.

Family trusts for property protection

A trust is not for everyone. Still, many clients ask about it once they hold property in Whangamata or the wider Coromandel. It can form part of a longer plan around ownership and protection.

Wills and estate planning

Buying property can be the moment you update a will. It is a simple step that keeps your intentions clear.

If you want help with either, we can point you to the right service and talk you through the next step.

Other legal services we can help with

Some clients come to us for property, then ask for support with other areas as well.

Services

- Immigration NZ

- Estate planning

- Trust law

- Asset protection including family trust law

- Business law

FAQs

Do I need a lawyer before I make an offer

It helps. A quick review before you sign can prevent expensive fixes later.

What conditions should I ask for in Whangamata

Most buyers consider solicitor approval, finance, and insurance approval. Some also use due diligence depending on the property.

What is a LIM, and do I need one

A LIM is a council report. Many buyers use it to check risks, consents, and notices.

What is an easement, and should I worry

Not always. It depends what the easement allows and where it sits. We explain what it means for access, use, and future plans.

Can you help if I am not in Whangamata

Yes. Many people buy from Auckland or elsewhere. Signing and updates can often be handled remotely.

Can you act for me when dealing with my bank

Often, yes, depending on the lender and the transaction.

What happens during a mortgage refinance

The old mortgage gets discharged and the new mortgage gets registered. We coordinate signing and timing with the bank.

Talk to a conveyancing lawyer

If you are buying, selling, or refinancing in Whangamata or the wider Coromandel, contact Quay Law early. You will get clear steps and steady updates.

Quay Law

Address 165 Orakei Road, Remuera, Auckland. We have a local representative in Whangamata. (Brenton Place)

Phone 09 523 0478

It is easy to complete our conveyancing fee request form, or fill out the enquiry form. One of our qualified New Zealand lawyers will call you back shortly.